Welcome to Anugraha Satellite Township! – An evolving model town!

Township News

-

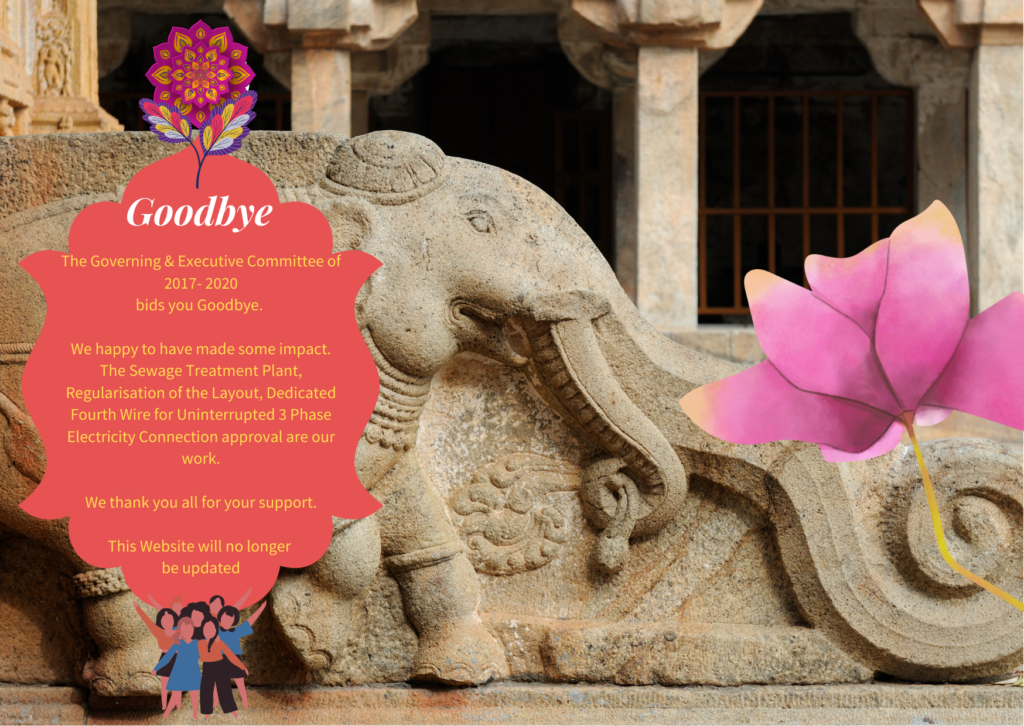

Farewell!

[vc_row][vc_column][vc_column_text]

All things come to an end!

The present committee bids you farewell and wishes you well in the forthcoming years.

We wish to sincerely thank all our volunteers for extending generously, their time, energy, attention, support and assistance towards the many objectives and outcomes we have achieved.

Of the Outcomes, the following will stand testimony for years and years to come:

- The Sewage Treatment Plant

- Regularisation of the Layout - The Anugraha Satellite Township layout sketch copy is here.

- Approval for dedicated fourth wire for uninterrupted 3 phase electricity supply.

- Extensive documentation of all the sale deeds, gift deeds, encumbrance certificates, pattas, accounts, common property, etc.

- Regularisation of individual plots of a majority of owners.

This site will be maintained at the cost of the Secretary, Dr. Jagan Mohan R to serve as an archive and documents repository for as long as possible.

Its Goodby from all of us! Wish you all the very best! This site will no longer be actively updated.

If any situation warrants it, we will post important information here.

[/vc_column_text][/vc_column][/vc_row]

-

ELECTIONS 2020 - CIRCULAR

-

Association Elections 2020 - Announcement Notice

-

STP Project Corpus Fund - Auditor Report Received

-

Announcement - New Office of the Association

-

Regularisation - Step by Step Guide

-

Absolute Order of the Sub Divisional Magistrate - regarding STP

Choose Your Topic

Archives of Updates

-

ELECTIONS 2020 - CIRCULAR

-

Guide - Apply for Regularisation of your PLOT

-

Farewell!

-

Eligible Voters List - Elections 2020

-

Elections 2020 Notice & Nomination Form

-

Donations Drive for School Children

-

Association Elections 2020 - Announcement Notice

-

Petitions for Mutation of Patta, Takeover of Roads & Levy of House Taxes

-

Petition for Project Director, DRDA, Cuddalore

-

Meeting with District Collector

-

Maintenance Charges Dues Recovery Initiated

-

Electricity Additional Security Deposit Demand Notice from TNEB/TNGDC

-

Petition to BDO & AD Panchayat

-

Children's Day Competitions

-

Kerala Flood Relief Drive

-

STP Project Corpus Fund - Auditor Report Received

-

Happy Independence Day!

-

Review Visit by Sub Collector to STP

-

Inspection Visit by Team from Pollution Control Board & Collectorate

-

Meeting with the Block Development Officer at Circuit House

-

Announcement - New Office of the Association

-

New Office Inaugurated with a simple Puja

-

Regularisation - Step by Step Guide

-

Farewell to Hon'ble Sub Collector cum SDM

-

Absolute Order of the Sub Divisional Magistrate - regarding STP

-

Legal Consultation

-

Bank Accounts unsuspended.

-

Bank Account Suspended

-

Updated Maintenance Accounts for May 2018

-

Maintenance work at the STP

-

Maintenance work at STP site

-

Executive Committee Meeting

-

Visit to Cuddalore STP

-

TN Pollution Control Board Visit

-

Hydrology Expert Visit

-

Engineer Kumar 60th Birthday

-

Maintenance Office closed

-

Review of STP Operations on the Spot

-

-

The Spl. GB will be LIVE ONLINE!

-

Treated Water from STP Tested, Report Satisfactory

-

The Pipeline is complete! It Flows!!!

-

Brief Presentation on Process Sequence of STP

-

Progress Report 22 May 2018

-

Progress Report - Second Week of May

-

FAQ - Village Panchayat Approval of Layout Valid?

-

Last Date for Application for Regularisation Extended

-

Assisted Filing of Application for Regularisation of Plot

-

Advisory: Please Apply for Regularisation of your PLOT

-

News Articles on Unapproved Layouts & Regularisation

-

STP is Operational!

-

Sewarage Pipeline Modification Plans - Part 1

-

Request Letter to The PSBB Millennium School for Access

-

Safety Instructions for Visitors to the STP

-

Inauguration of the Sewage Treatment Plant

-

Planned Features for Anugraha Online

-

Administration of Township Temples

-

Anugraha Township - Karikkan Nagar Accord

-

Anugraha Township - Karikkan Nagar Talks - 2nd Round

-

STP Work in Progress – A Photo Essay – Part 10

-

Karikan Nagar Issue - Update

-

Meeting with Karikan Nagar Representatives

-

STP Work in Progress – A Photo Essay – Part 9

-

STP Work is On - An Update

-

STP Work in Progress – A Photo Essay – Part 8

-

Happy & Prosperous Pongal Greetings

-

Spent, Committed and Projected Expenditure - STP - Jan 2018

-

Plans for New Year 2018

-

New Dawn, New Day, New Year

-

STP Work in Progress – A Photo Essay – Part 7

-

Note of Appreciation

-

STP Work in Progress – A Photo Essay – Part 6

-

STP Work in Progress - A Photo Essay - Part 5

-

STP Work in Progress - A Photo Essay - Part 4

-

STP Work in Progress - A Photo Essay - Part 3

-

STP Work in Progress - A Photo Essay - Part 2

-

STP Work in Progress - A Photo Essay - Part 1

-

STP Project Civil Work Order issued

-

Power Issue - Exploring Option for Sub-Station at our OSR Park

-

STP Bhoomi Pooja & Ganesh Pooja Photographs

-

Progress Report - 21 Nov 17

-

Progress Report for Hon'ble Collector & Sub Collector

-

Proceedings of the General Body Meeting - November 2017

-

Invitation to General Body Meeting - November 2017

-

General Body Meeting Presentation - November 2017

-

The Project begins - Update on Progression

-

Secretary Notes on Outstanding Issues

-

Wish you a very Happy Diwali

-

Meeting with Collector & Sub Collector - Update

-

TWAD Board Visit

-

Second Public Hearing, General Body Meeting, Oath & Office Swearing In Ceremony